- Get link

- Other Apps

The concept of cash laundering is essential to be understood for these working within the financial sector. It is a process by which soiled cash is converted into clean money. The sources of the cash in actual are felony and the money is invested in a manner that makes it appear to be clear cash and hide the identification of the felony a part of the money earned.

While executing the monetary transactions and establishing relationship with the new prospects or maintaining existing customers the duty of adopting enough measures lie on every one who is a part of the group. The identification of such element to start with is easy to take care of instead realizing and encountering such situations afterward in the transaction stage. The central financial institution in any nation provides full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to discourage such conditions.

Over time these have evolved in line with international standards set by the FATF an intergovernmental body which promotes effective implementation of measures for combatting money laundering and terrorist. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory.

Anti Money Laundering And Counter Terrorism Financing

We summarise some key changes in this briefing.

Money laundering regulations 2017 scope. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The MLR 2017 repealed and replaced the Money Laundering Regulations 2007 the 2007 Regulations and implemented the Fourth EU Money Laundering Directive in the UK. It does not currently have the status of having been approved by HM Treasury.

Scope and definitions Section 1. The regulatory scope of the AML law has expanded on the definition of money laundering. They set administrative requirements for the anti-money laundering AML regime within the regulated sector and outline the scope of customer due diligence.

Regulations 2017 12 The UK has had regulations intended to prevent money laundering in place for nearly thirty years. The Regulations make amendments to the existing Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. Some of the most.

MLR 2017 is more prescriptive on risk mitigation procedures monitoring on Politically Exposed Persons PEPs and conditions for reliance on third parties for customer due diligence. The Regulations make limited but potentially significant amendments to the UKs AML regime through the amendment of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which implemented the Fourth EU Money Laundering Directive. 2 These Regulations come into force on 26th June 2017.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. The 2017 MLRs have been informed by the responses submitted and. This Practice Note sets out the scope and application of the Money Laundering Regulations 2017 MLR 2017 which came into force on 26 June 2017.

Which financial institutions are in scope. MLR 2017 posed a strong obligation on relevant persons to adopt a more thought risk-based approach towards AML and CTF prevention in particular in how they conduct due diligence. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime.

In addition the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the 2017 Regulations impose on in-scope organisations anti-money laundering AML and counter-terrorist financing CTF requirements relating to risk assessments policies procedures and controls customer due diligence. To view the full document sign-in or register for a free trial excludes LexisPSL Practice Compliance Practice Management and Risk and Compliance. 1 the following pursuant to sections 18 and 19 of the Ordinance on Measures against Money Laundering and Terrorist Financing 200992.

Decided on 26 June 2017. Time is now running short and the legislation must be in force by 26 June. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Past directives target and punished offenders that acted directly in the act of money laundering this Directive expands to the regulatory scope and encompasses the so called enablers of money laundering. These regulations implement the EU Fifth Money Laundering Directive Directive EU 2018843 5MLD in the UK. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

Following Treasurys initial consultation on how to implement MLD4 in September 2016 it has now published the feedback to that consultation and the draft Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017. Money laundering is commonly regarded as the process whereby the proceeds of crime are changed or disguised so to hide their unlawful origin. The MLR 2017 repealed and replaced the Money Laundering Regulations 2007 the 2007 Regulations and implemented the Fourth EU Money Laundering Directive in the UK.

Finansinspektionens regulations regarding measures against money laundering and terrorist financing. They set administrative requirements for the anti-money laundering AML regime within the regulated sector and outline the scope of customer due diligence. The Anti-Money Laundering Regulations 2017 The Anti-Money Laundering Regulations 2017 AML Regulations were gazetted on 20 September 2017 and come into force on 2 October 2017.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations. Money Laundering Regulations 2017.

Today the Money Laundering Regulations 2017 MLRs 2017 or Regulations has become effective transposing Fourth Money Laundering Directive EU 2015849 - 4AMLD into UK law.

Reporting Suspected Money Laundering And Terrorist Financing English By Finansinspektionen Issuu

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

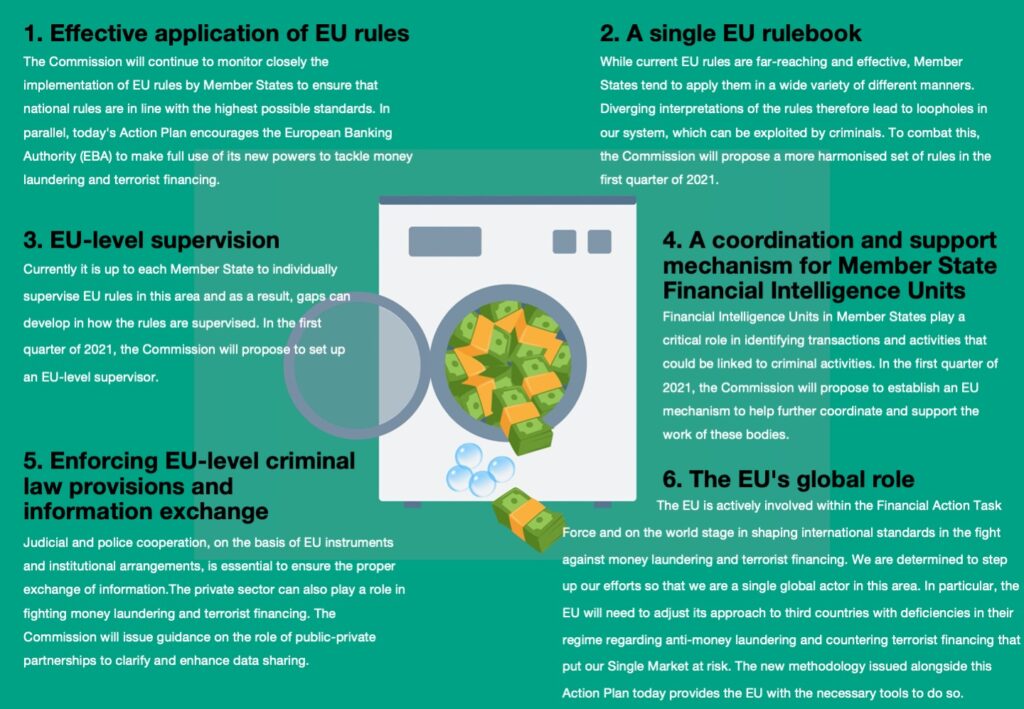

When One Door Shuts Another One Opens The Commission S New Aml Action Plan Planet Compliance

Anti Money Laundering And Counter Terrorism Financing

Pdf Anti Money Laundering Regulations And Its Effectiveness

Brief Summary Of The Money Laundering Regulations 2017

9 Effects Of Money Laundering Summarized Download Table

Https Www Ppatk Go Id Backend Assets Uploads 20200221111540 Pdf

Prevention Of Money Laundering Gov Si

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Anti Money Laundering And Counter Terrorism Financing

Risks Free Full Text Efficiency Of Money Laundering Countermeasures Case Studies From European Union Member States Html

The world of regulations can look like a bowl of alphabet soup at times. US cash laundering regulations are not any exception. We have compiled a list of the top ten cash laundering acronyms and their definitions. TMP Danger is consulting firm focused on defending monetary services by decreasing danger, fraud and losses. We have huge financial institution experience in operational and regulatory danger. We have a robust background in program administration, regulatory and operational danger in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many opposed penalties to the organization due to the dangers it presents. It will increase the likelihood of major risks and the opportunity value of the financial institution and in the end causes the financial institution to face losses.

Comments

Post a Comment